Period, the first cash flow is not discounted since there hasn’t been any time to apply the interest rate. The implication of this selection can be most easily understood with the first investment. If the first investment occurs at the end of the first year, choose End. For instance, if your initial investment (a negative number) occurs on Day 1, choose theīeginning option. Periodic Cash Flow OptionsĪfter selecting the fields, the Periodic options are presented:įor Cash Flow analysis, it’s important to determine whether the first item represents an event at the beginning of the time period

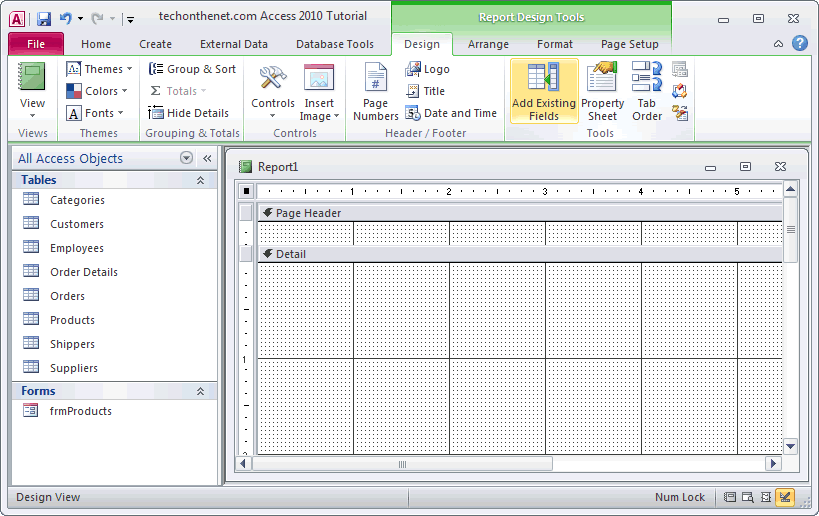

You can optionally specify a Weight Field which can be used in situations where you have a field for the receiptĪmount and another weighting field that specifies the quantity of those receipts. Natural order, which may or may not be okay. If no group field is specified, the Sort Field is not required and Total Access Statistics analyzes your records in their This may be the AutoNumber field of your table orĪnother field that can be used to ensure Total Access Statistics processes each cash flow in the right order. The Sort Field is used to ensure your cash flows are sorted properly. Group Fields let you generate a separate set of analysis for each combination of unique values among the group fields. Should be negative for payments (investments or outflows), and positive for receipts (returns or inflows). Each field you selected is analyzed separately. The Value Fields contain the cash flow data. The following field selection screen appears for Periodic Cash Flows: Depending on the frequency of your cash flows, you’d enter the appropriate interest rate for each period. Most common intervals are annual, monthly, and quarterly. Payments or receipts can vary in size but The simplest and most common cash flow analysis is based on periodic transactions. Tables, you can add them to your forms and reports.įinancial Calculations were added to Total Access Statistics for Microsoft Access 2010, and X.8 versions for Access 2007 and earlier.

Generated making it far more powerful than performing the calculations in Microsoft Excel.

0 kommentar(er)

0 kommentar(er)